There have been a lot of questions regarding the impact of the new Health Care Reform Act that goes into effect January 1, 2013 and how it will affect home sellers in Los Altos. The Act imposes a 3.8% Medicare tax on investment income which includes the disposition of real property. Here are some points to remember. Note: The content of this post is for informational purposes only. One should talk to his/her financial advisor before buying or selling one’s home.

- The Medicare tax applies to individuals with a Modified Adjusted Gross Income of $200,000 and above.

- The Medicare tax applies to married couples with a Modified Adjusted Gross Income of $125,000 (if filing separately) and $250,000 (if filing jointly) and above.

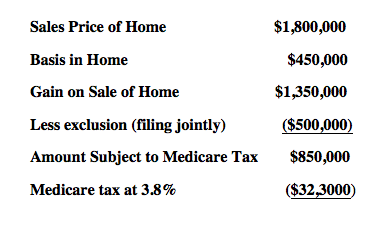

- Regarding the sale of a personal residence, the Medicare tax only applies to the taxable portion of the sale. Therefore the $250,000 exclusion (if filing as an individual) and $500,000 (if filing jointly) is not included.

- If the gain on the sale of your qualified home is exactly $500,000 and both you and your spouse have lived in your home at least 2 of the last 5 years, there is no additional tax.

Example:

- If you are married and file a joint return, have an adjusted gross income of $250,000 or above, have lived in your home at least 2 of the last 5 years and have a gain on the sale of your home of $850,000, you will pay an additional (medicare) tax of $32,500.

Interested in Selling your Los Altos home?

Interested in Buying your dream Home in Los Altos?

Give me a call at 650 917-4250

I’ve been licensed and actively selling residential real estate locally since 1993.

Related posts

September 22, 2022